Islamic Wealth & Asset Management

Introduction

Since 2012 I have been delivering sharia-compliant asset management through my own brand, Safa Investment Services.

Safa provides a system of asset allocation and security selection proven to equal or exceed conventional investing. Easily adapted to any kind of investor, Safa is grounded in financial market scholarship, in particular Modern Portfolio Theory.

Yet Safa is practical. It relies on the availability of hundreds of securities that almost anyone can purchase for their portfolio. From these securities, one can create optimized asset allocations that match or exceed the performance of any conventional asset manager.

In Switzerland, wealth and asset management are regulated by the Swiss Financial Market Authority, where I operate as a financial advisor.

About Asset Management

Professional asset managers match the needs of savers of capital with those of users of capital. Savers are households, pension funds, insurance companies, endowments, governments, and corporate and bank treasuries. Users of capital are often the same.

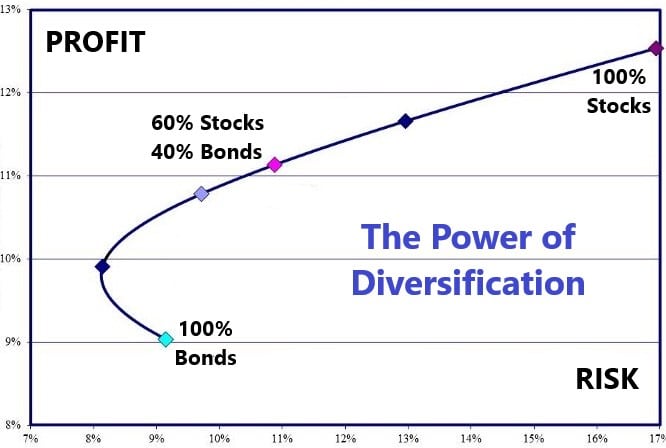

Concentrating investments in one asset class—real estate, for example—is risky. Most savers don’t need more risk. They need a balanced and diversified approach to investing. A professional asset manager ensures clients get diversified investing across multiple asset categories.

Asset management worldwide is a business with over $150 trillion in assets under professional management. Asset managers are responsible for buying a mix of investments that reflect the client’s risk profile. Asset management is based on Modern Portfolio Theory, a practical means of investing backed by decades of research and many Nobel Prizes.

Investors normally don’t think about spiritual goals when investing. They seek professionalism first. A professional investment manager knows how to match a client’s appetite for risks and rewards with diversified investments that reflect the client’s long-term investment goals.

#1 An Introduction to Islamic Wealth & Asset Management, by Dr. John A. Sandwick

The tutorials below are meant to reveal some simple truths about how to invest savings

#2 The Science of Asset Management

Diversification is key. Investments are in four categories: Cash, Bonds, Stocks and Alternatives. * Investments are made globally. Data and research support sophisticated asset allocation tools to create optimized, diversified global portfolios.

During those 30 years there were 6 years with negative returns, and 24 with positive returns. Risk, as measured by Standard Deviation, was a very low 7.03%.

In other words, Modern Portfolio Theory has been generous to those who save.

The beauty of Modern Portfolio Theory is that it can deliver the same kind of results in the future. One does not need to worry about low rates in Europe, slow economic growth in America, or the next global financial crisis. Over time, individual events become unimportant. The potential for human economic activity is unlimited. In this sense, history will repeat itself.

*Alternative investments comprise any investment that is not cash, bonds, or stocks. Typically, this includes real estate, private equity, cryptocurrency, or private markets (credit and equity).

#3 Combining the Science of Investing with Sharia

What is sharia? Muslims know it’s about principles laid down in the Quran that encourage ethical behavior. Number one, it prohibits interest. But it also avoids unnecessary speculation, buying assets that don’t exist (e.g., derivatives) and avoiding haram activities (e.g., shares in banks or finance companies).

For investing, this means no bonds, hedge funds, or shares of companies that violate sharia.

My doctorate took the current universe of Islamic investments (all liquid, meaning they could be sold at any time for cash) and constructed portfolios according to Modern Portfolio Theory.

These Islamic portfolios were then matched against identical investment strategies from major global asset managers. The result? In almost every case the sharia-compliant portfolios had more profit with less risk.

#4 What this Means for Muslims (and even non-Muslims)

My doctorate shows that Muslims now do have a choice. They do not need to sacrifice their beliefs when it comes to investing their savings. And following sharia indicates more profit with less risk. Everyone wants that.

What we have now is important. Islamic wealth and asset management are not only possible, but they are also statistically superior to conventional investing.